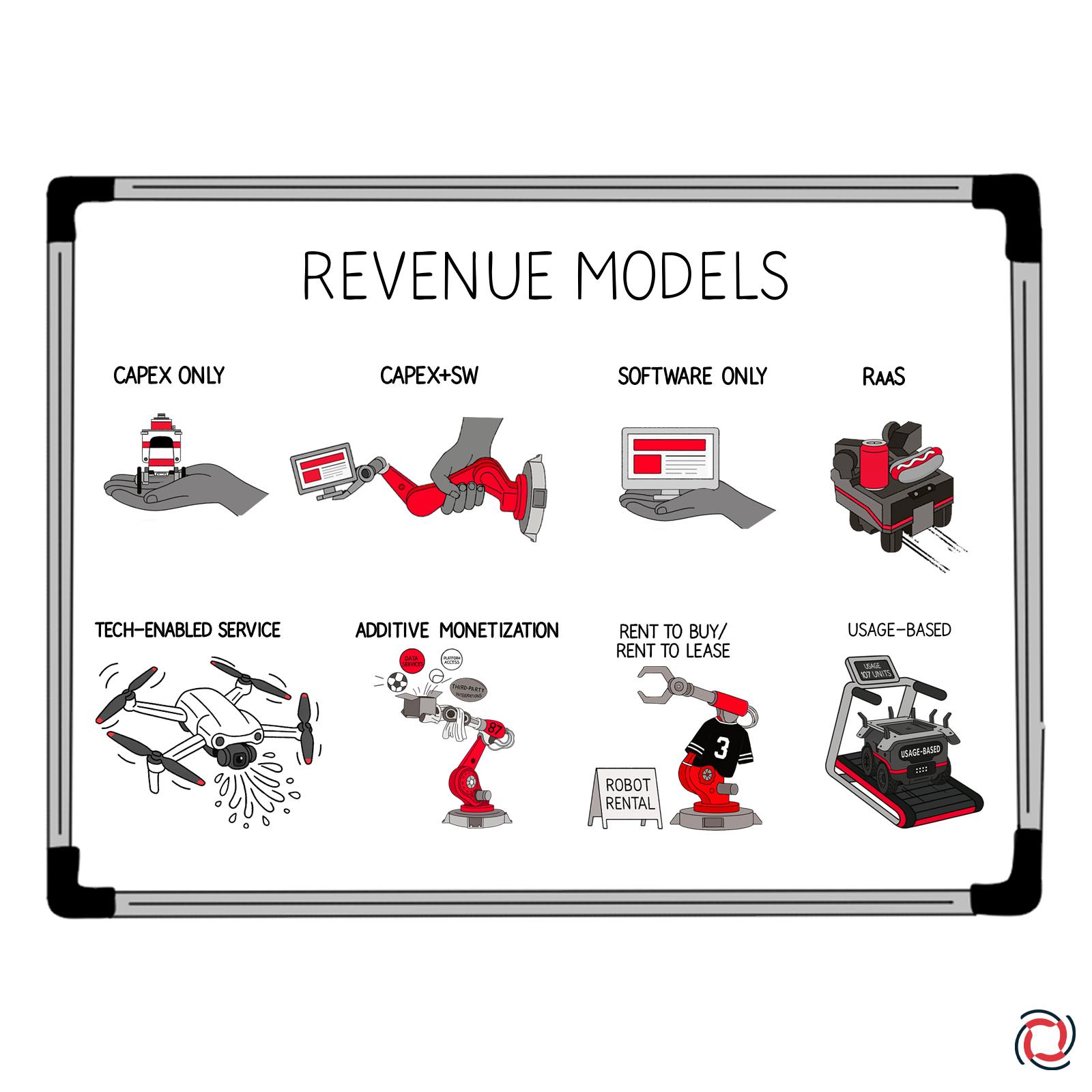

Revenue Models

Game Situations and Adjustments

Game Situations and Adjustments

What sets robotics apart as a highly attractive asset class is its transformative potential across multiple industries, complex high performance products, highly sticky customers, multiple revenue streams including hardware and software, and overall robust long-term revenue potential forecasted to reach $200B by 2030.

Today, robotics startups are much better equipped to identify where smart machines can add real value with high impact.

This sets the stage for a new era—one where robotics companies not only build defensible products but scale them faster than ever before. Today, there are leading robotics companies from seed to late stage that are already demonstrating this faster pace, and it’s only going to accelerate more.

This Playbook has already covered some critical

growth accelerators for robotics companies:

| Pinpoint a high-pain, high-frequency problem (Chapter 2) | ✔️ |

| Validate a clear use case in a multi billion-dollar market (Chapter 3) | ✔️ |

| Engineer a future-proof product with scalable tech (Chapter 4) | ✔️ |

| Build a go-to-market engine to cross the robotics double chasm (Chapter 5) | ✔️ |

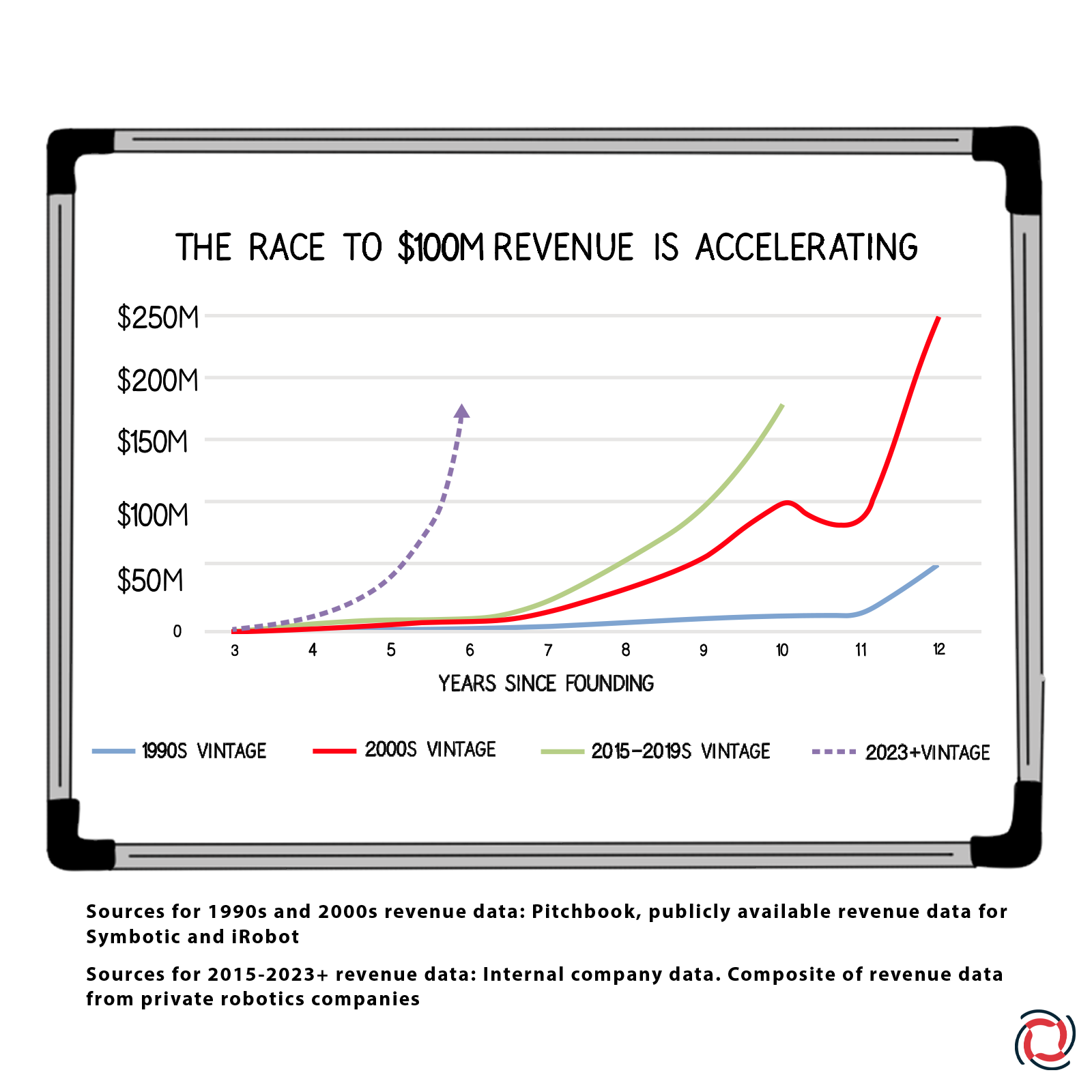

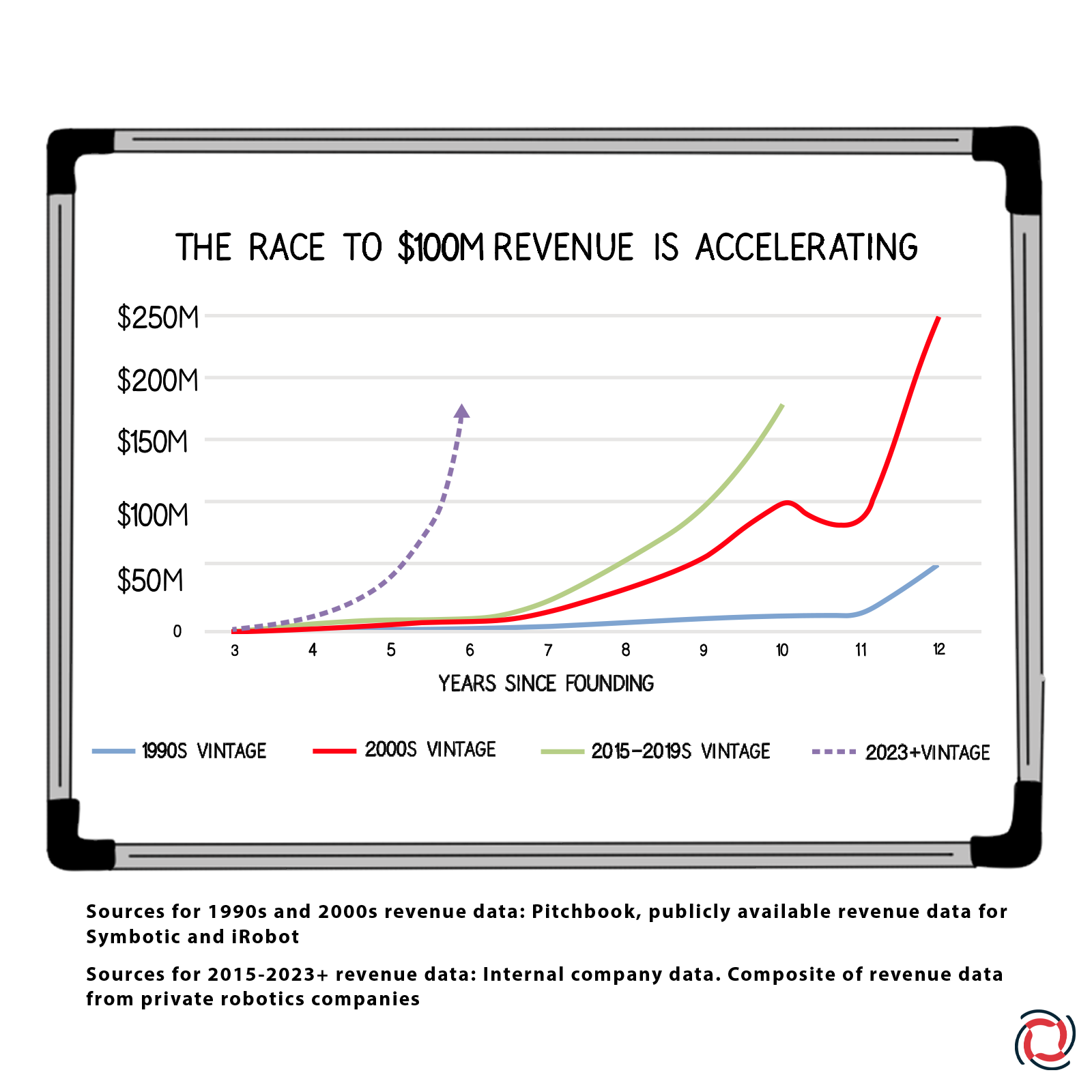

This chart compares early‑stage revenue trajectories for a representative set of very successful robotics companies over time. Successful legacy robotics companies followed a much slower path to revenue compared to today’s modern cohorts. Time-to-revenue has compressed dramatically, and the AI-first generation (2023+ vintage) is positioned to compress it even further.

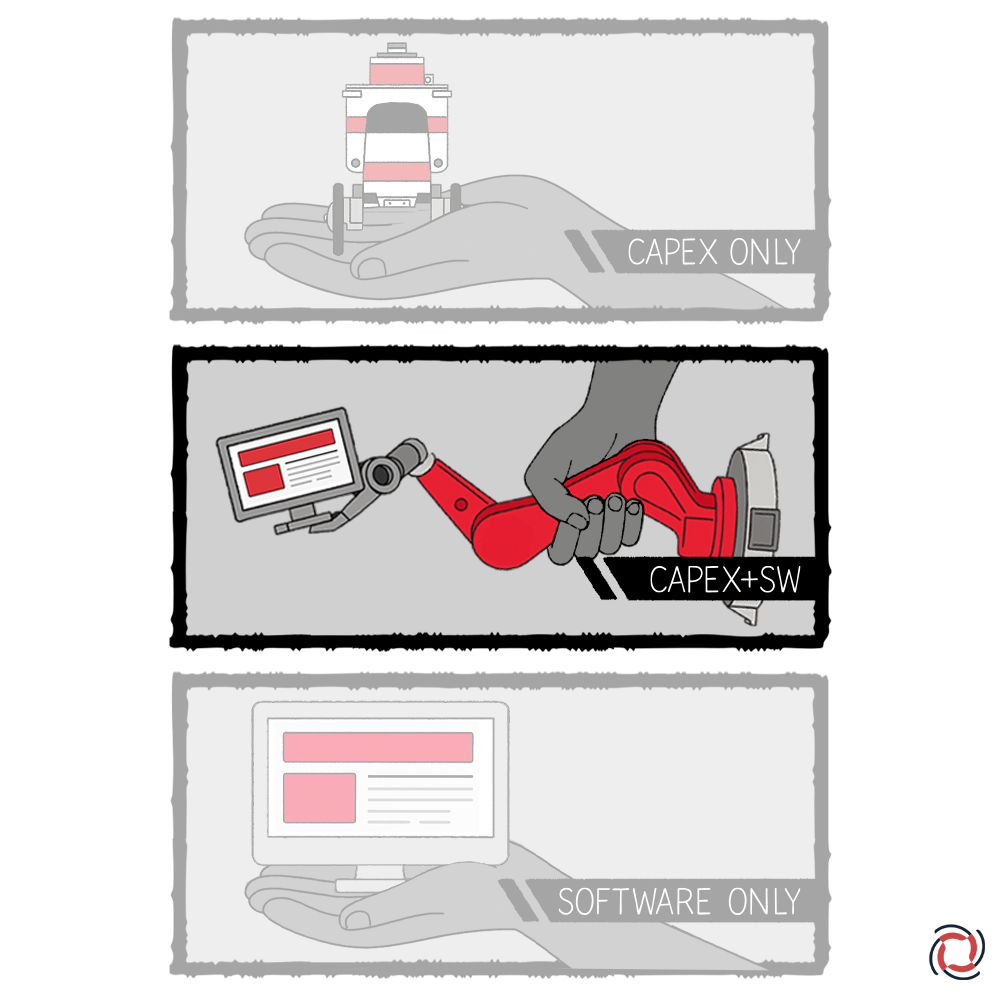

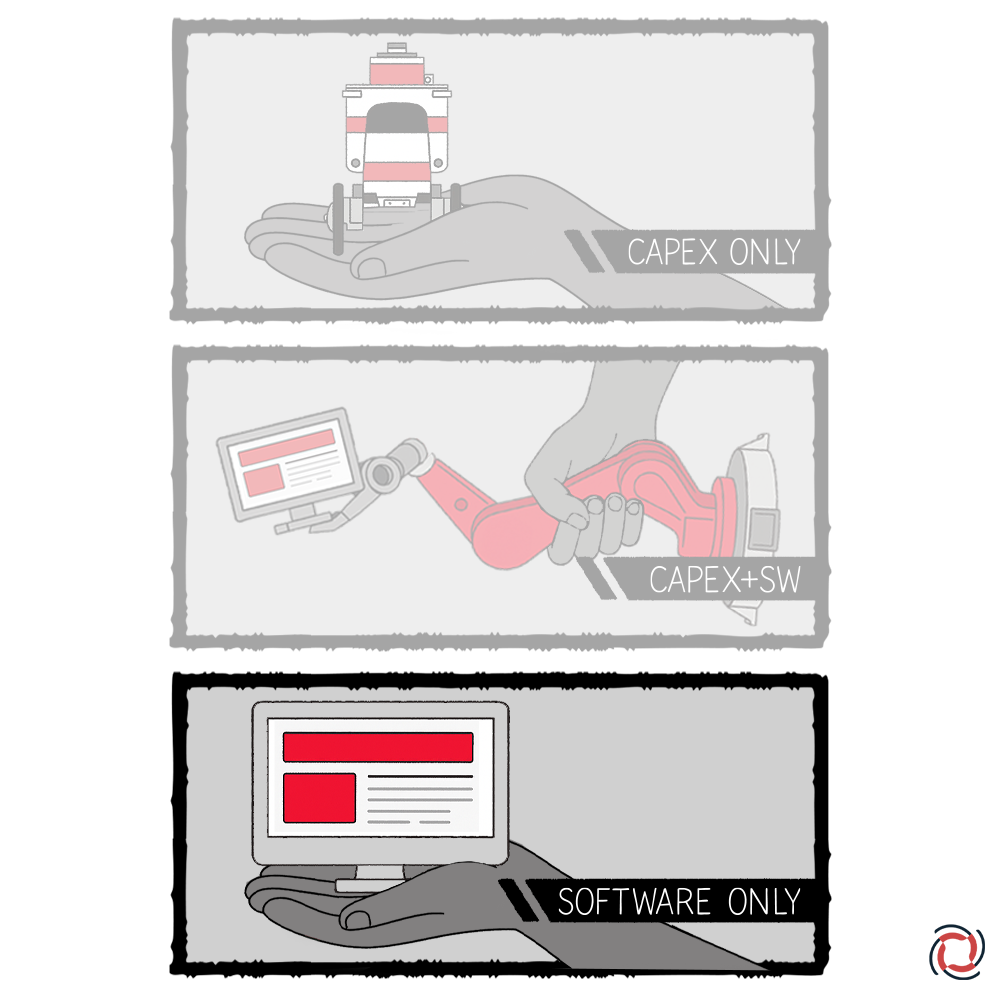

Historically, robotics companies operated with long timelines to meaningful revenue. In the early days, most followed a pure CAPEX model, selling expensive hardware with minimal recurring revenue. Early-stage traction was slow due to high upfront costs and a market that wasn’t fully ready. Adoption and execution, however, is still highly market sector-specific. What works in warehouse automation may not translate directly to construction, agriculture, or healthcare. While challenges still remain, many historical adoption barriers have begun to erode.

The robotics industry has been completely transformed over the past two decades: massive technology convergence, world‑class experienced founding teams, dramatically cheaper hardware, and rapid software development have unlocked a new era of precise product targeting and execution—enabling clear, mega‑market use cases for robotics. At the same time, macroeconomic pressures have created an imperative for automation. Together, these forces are propelling the robotics ecosystem into an era of unprecedented velocity and scale.

Robotics startups must choose a revenue model that aligns with their technology, target market, and customer buying behavior. Because robotics spans physical systems, software, and services, companies can adopt a wide range of monetization strategies—from hardware sales to software subscriptions to outcome-based services. The next two sections outline both primary and secondary revenue models in robotics, their definitions, and the key advantages and challenges of each. It is important to deeply study the target market and customer, and understand how these revenue models align with customer buying preferences. This is critical for shaping adoption, cash flow, investor appeal, and long-term scalability.

Definition:

Involves a one-time, upfront sale of the robot to the customer, who then owns and operates it. The company delivers the robot, possibly with initial setup, and recognizes full revenue at the point of sale. Ongoing maintenance and operation are the customer’s responsibility.

Pros:

– Immediate cash flow and revenue recognition

– Simple and familiar to capital purchasers

– Robot ownership liability is the customer responsibility

Cons:

– High barrier for customer adoption due to upfront cost

– Lowest customer engagement

– Minimal or no guaranteed recurring revenue

Definition:

Combines a one-time hardware sale with recurring revenue from software, service, or maintenance. The customer owns the robot, but pays ongoing fees to access essential functionality, updates, or support. This creates a hybrid revenue stream for the robotics company and maintains an ongoing relationship with the customer post-sale.

Pros:

– Cash and revenue recognition for hardware immediately

– Balances short-term revenue with long-term recurring income

– Sets a recurring base revenue that will grow with more customers

– Easier upsell opportunities over time with an ongoing engagement

Cons:

– Still requires large upfront customer investment

– Increased barrier to adoption and potentially long sales cycles

– Recurring revenue is still small percentage of total revenue

– Reduced predictability of revenue

Definition:

Software-only providers monetize robotics software—such as control systems, analytics, or fleet management—independently from the hardware. It’s typically delivered via a SaaS model, with optional licensing or per-robot fees. The robotics company focuses purely on software value, selling to hardware OEMs, integrators, or end users.

Pros:

– Recurring revenue

– Can scale independently of hardware deployments

– Able to integrate with multiple hardware platforms

– Highest gross margin potential, able to scale rapidly with minimal marginal cost

– Can become embedded and sticky within customer workflows, increasing retention

Cons:

– Must rely on third-party hardware adoption or installed base

– Requires strong API and integration capabilities

– Can be resource intensive to validate on each target hardware platform

– Highly competitive software market with existing players

– Limited upselling options

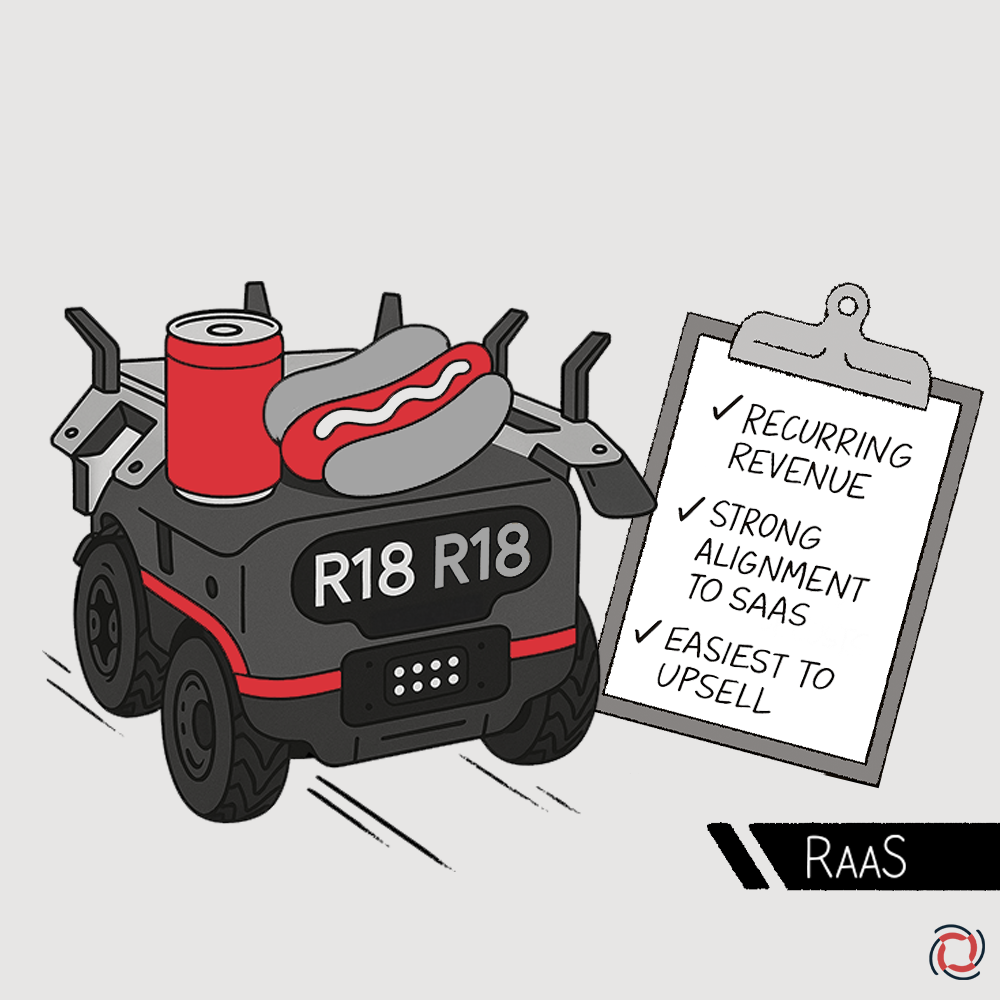

Definition:

Offers robotics as a fully managed service with subscription and typically no ownership transfer. Customers pay a flat fee or pay for operational outcomes rather than for equipment. The robotics company retains ownership and handles maintenance, support, and uptime.

Pros:

– Recurring, predictable revenue

– Reduced barriers to entry for customers

– Attractive to SaaS and many hardware investors with strong alignment to SaaS models

-Easiest model to upsell customers due to the ongoing service relationship that enables upgrades, add-ons, or extra units without new capital spend

Cons:

– Startup carries the upfront cost for the robot

– Minimal upfront revenue. Revenue is recognized over time

– Requires robust product and service infrastructure from 1st deployments

– Introduces some credit and payment risks

– Necessitates robot refurbishment or replacement with hardware upgrades

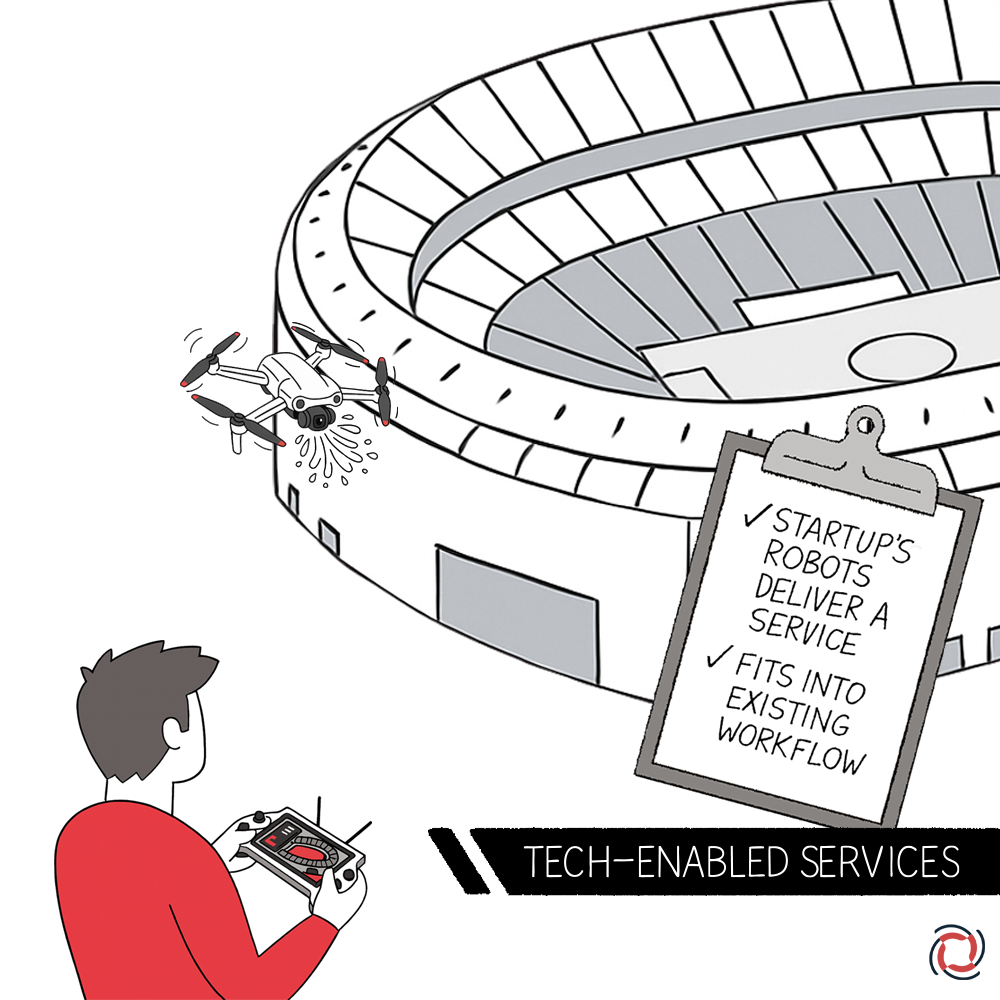

Definition:

This model uses the startup’s own robots to deliver a specific service, such as inspections, cleaning, or farming. The customer focuses on and pays for the outcome or deliverable, not the robot, while the startup owns, operates, and manages the robotic systems behind the scenes.

Pros:

– Works well in sectors where business is usually contracted or sub-contracted

– Naturally fits into existing workflow and business processes

– Allows the startup to control quality and value delivery, build a deep understanding of the customer and use case, and keep tight control of the customer experience

Cons:

– Operationally intensive (requires field teams)

– Underutilization and product downtime is the startup burden, not the customer

– Harder to scale quickly without capital or partnerships

Definition:

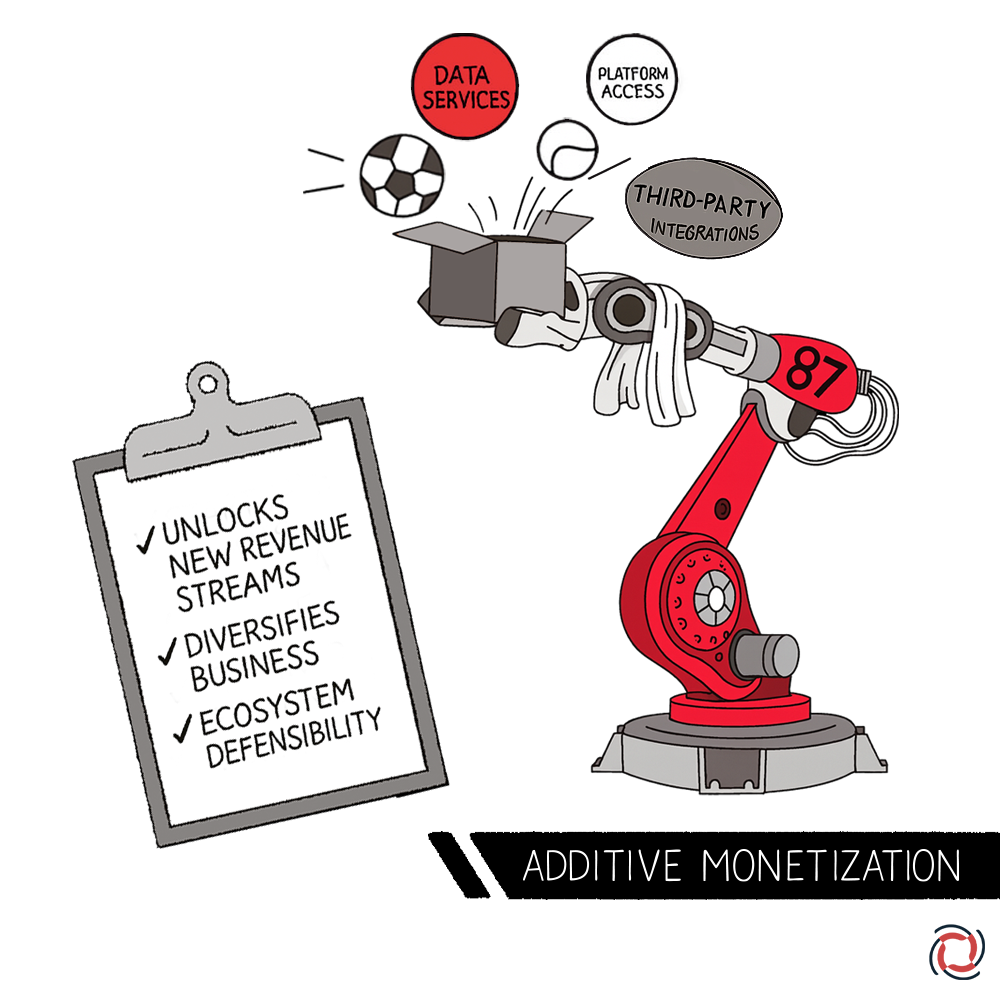

Robotics companies create additional revenue streams by offering data services, platform access, or enabling third-party integrations. This model is typically layered on top of hardware, software, or RaaS sales. It can include analytics, marketplaces, consumables or ecosystem monetization.

Pros:

– Unlocks new revenue streams, accelerates growth beyond baseline RaaS

– Stacking revenue streams diversifies the business, makes it even stickier

– Attractive to investors seeking upside and platform potential

– Builds ecosystem defensibility

Cons:

– High development and operational costs

– Risk of distracting team from core offering

– Can be outside the core competence of the existing team requiring new skills and processes

– May create channel conflicts with partners or competitors

– At the early stage, don’t turn down cash—flex your revenue model to fit the customer.

– Revenue models that work at the early stages may be different at later stages as the product-market-fit and value proposition solidify. Pivots in later stages are common.

– Start early to identify additional revenue streams – value added software, analytics, data, consumables, and/or services. Develop supporting infrastructure to pursue these opportunities in parallel to core product and go-to-market execution.

– Capex only is a classical approach. Any robotics company today with a Capex model should at least include a software and maintenance agreement. Better for operations, better for customer engagement, better to have some recurring revenue.

Definition:

This model allows customers to rent the robot for a defined period with the option to purchase or enter a long-term lease at the end. This model provides a lower-risk path to ownership. It’s often used to support evaluation, pilot programs, or very budget-constrained customers.

Pros:

– Customer pays via OPEX, not CAPEX

– Easier sell to cautious or budget-limited buyers due to reduced upfront costs and increased flexibility

– Clear customer business case for ROI

Cons:

– Startup carries the capital cost AND the customer adoption risk

– May require third-party financing support

– Revenues accrue slowly and unevenly

– Long product lifetime must be ensured

Definition:

Customers pay based on usage—e.g., per task, hour, or output—rather than fixed fees or subscriptions. This aligns cost with value delivered and typically avoids upfront CAPEX. Usage tiers or dynamic pricing can optimize revenue scalability. Most attractive for software only businesses.

Pros:

– Predictable, scalable revenue

– Strong customer alignment (pay for performance)

– Flexible for customers; removes CAPEX hurdles

Cons:

– Not always accepted in traditional industries

– Customers may reduce usage to control costs

– Harder to forecast revenue early on

– A critical priority at the very early stages is to capture revenue. Be flexible, get the product deployed, delight customers.

– Get creative with ultra customer-friendly approaches such as “rent to lease” and “rent to buy”. Prove the value and then drop these options from the offering once solid traction is established.