Go-To-Market Strategies

From Prototype to Early Majority

From Prototype to Early Majority

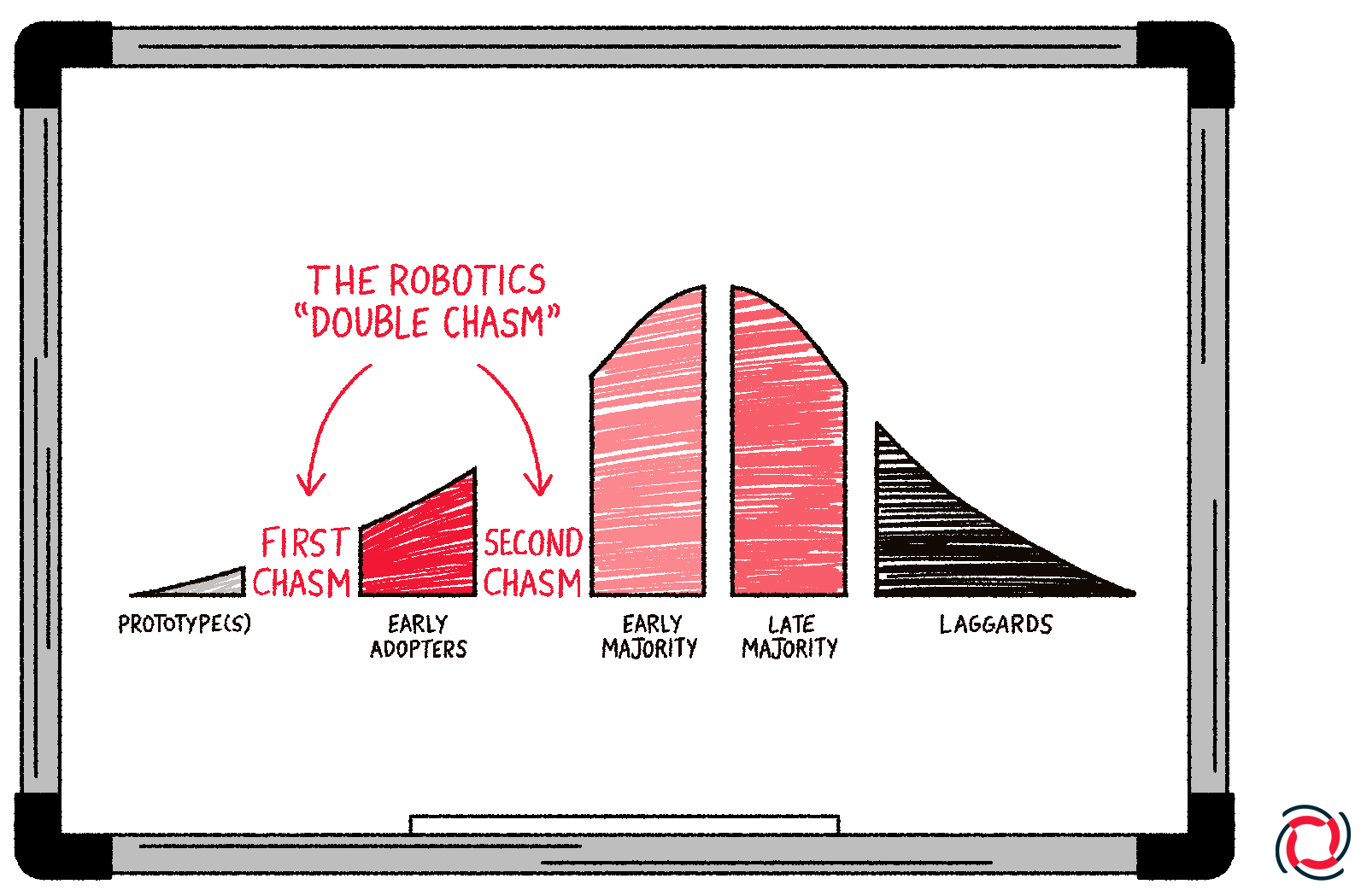

Go-to-Market (GtM) for Robotics Startups is different, especially when compared to pure software startups. We fondly refer to the challenge as the “Robotics Double Chasm”. The first chasm can occur when moving from prototype to early adopter customers. The second chasm typically occurs when trying to scale the number of customers beyond the initial set of early adopters. Any tech startup, from SaaS, Robotics, Biotech and Deeptech faces the first chasm as they strive to confirm initial product market fit (PMF). Once across this chasm, SaaS companies typically have a more continuous process of product refinement and customer expansion. However, with hardware involved, the second chasm for Robotics companies becomes much more distinct. This chapter outlines the key challenges and recommended approaches for both chasms.

Beyond the Chasms – Scaling through Early Majority customers – a topic for another chapter!

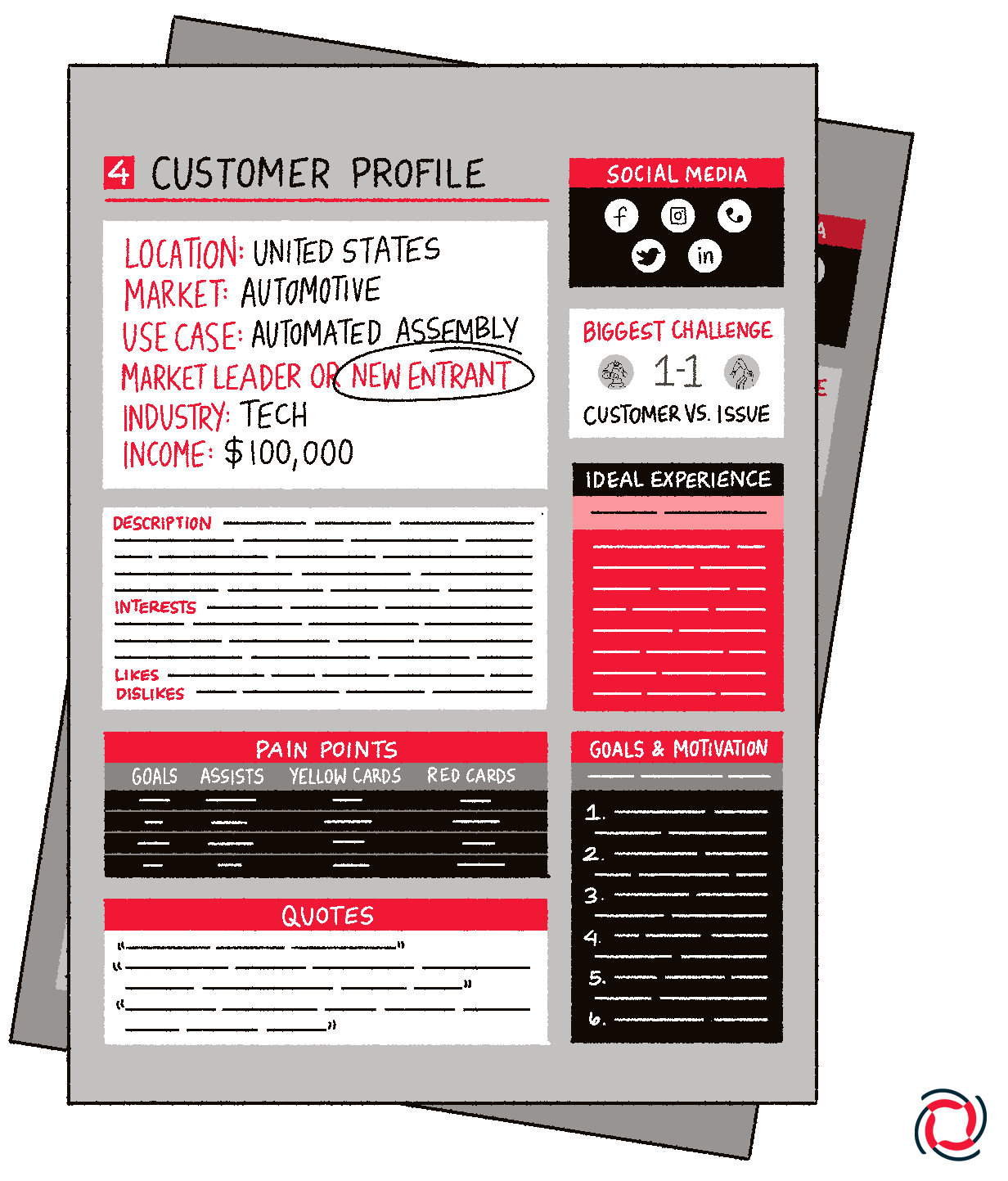

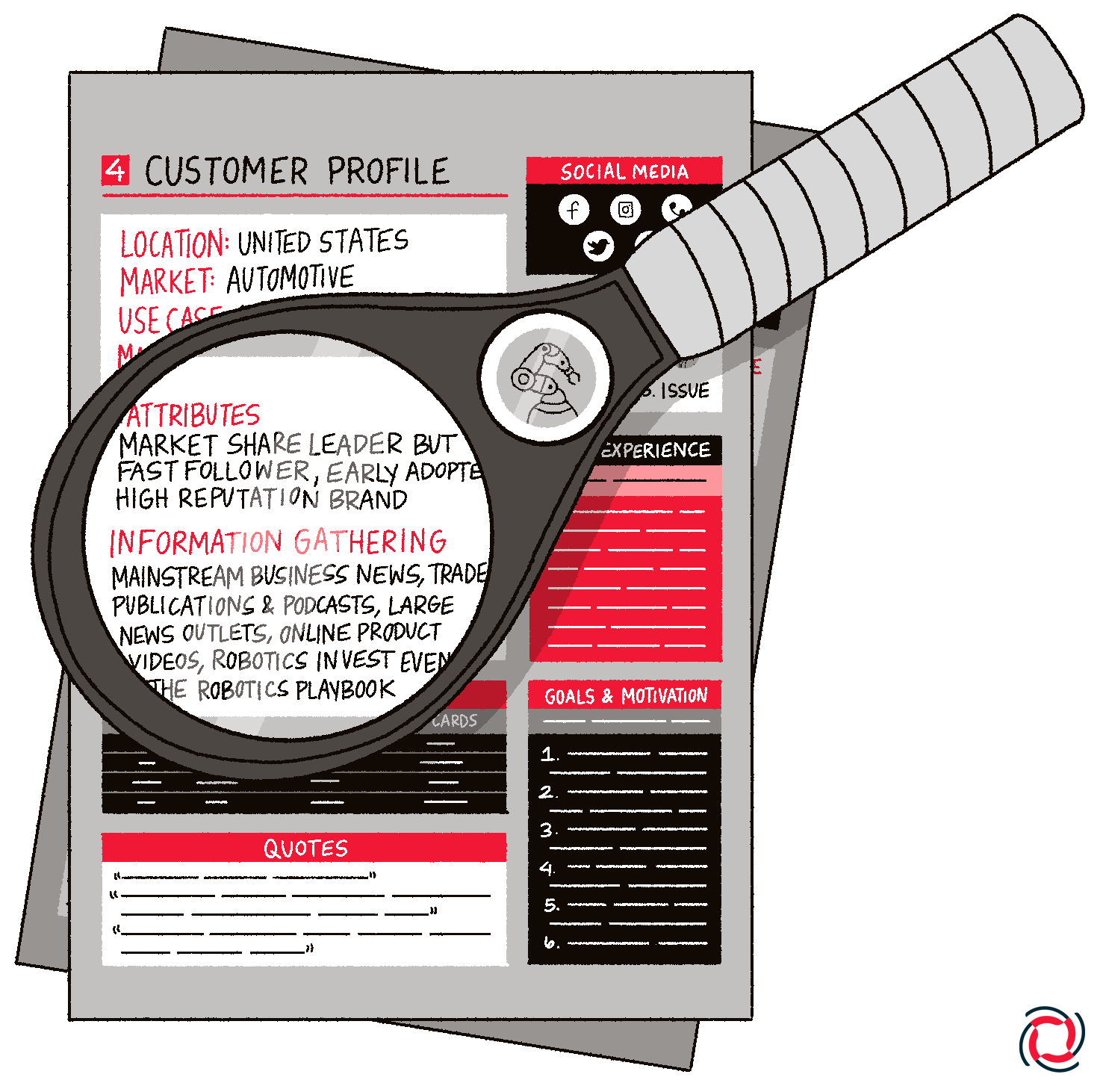

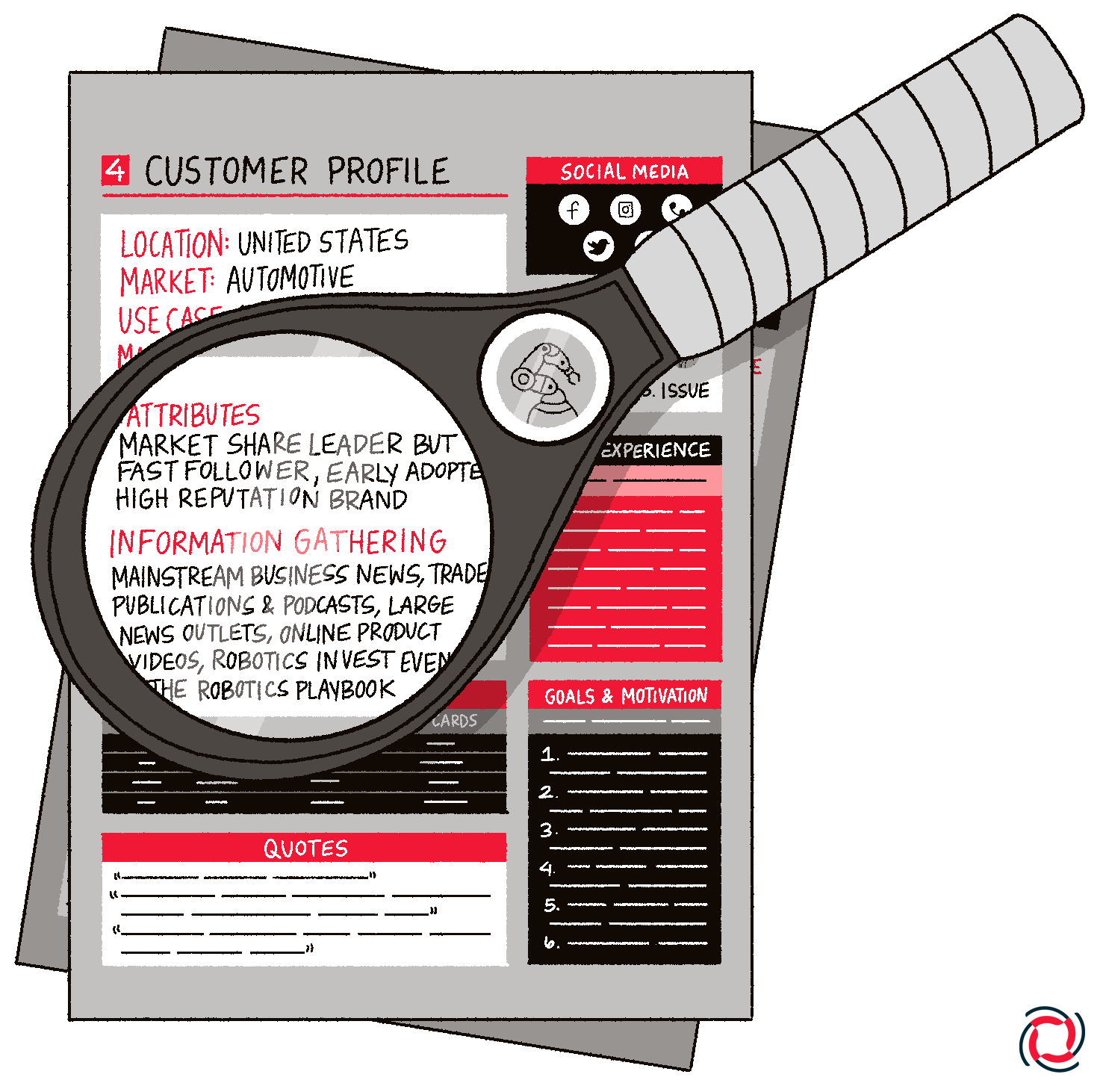

At this point, a startup has identified a market focus, zoomed in on a primary use case and conducted initial customer interviews, producing a preliminary set of target customers (see Chapter 3 on Evaluating Vertical Markets and Use Cases). Additionally, a working prototype has been defined and built (see Chapter 4 on Product Scoping & Definition). The combination of a working prototype and a set of target customers is an initial hypothesis toward validating the Ideal Customer Profile (ICP) and achieving initial PMF.

| Product-Market Fit Journey to Customer Success | |

|---|---|

| Phase | Key Success Factors |

| Optimize the Prototype for Customer engagement

Goal: Establish customer interest |

|

| Prototype to Product

Goal: Confirm customer adoption |

|

The Go-to-Market (GtM) starts when you have a robust first product and begin customer pilots with lead customers, kicking off the search for Product-Market-Fit (PMF).

Product Development Journey

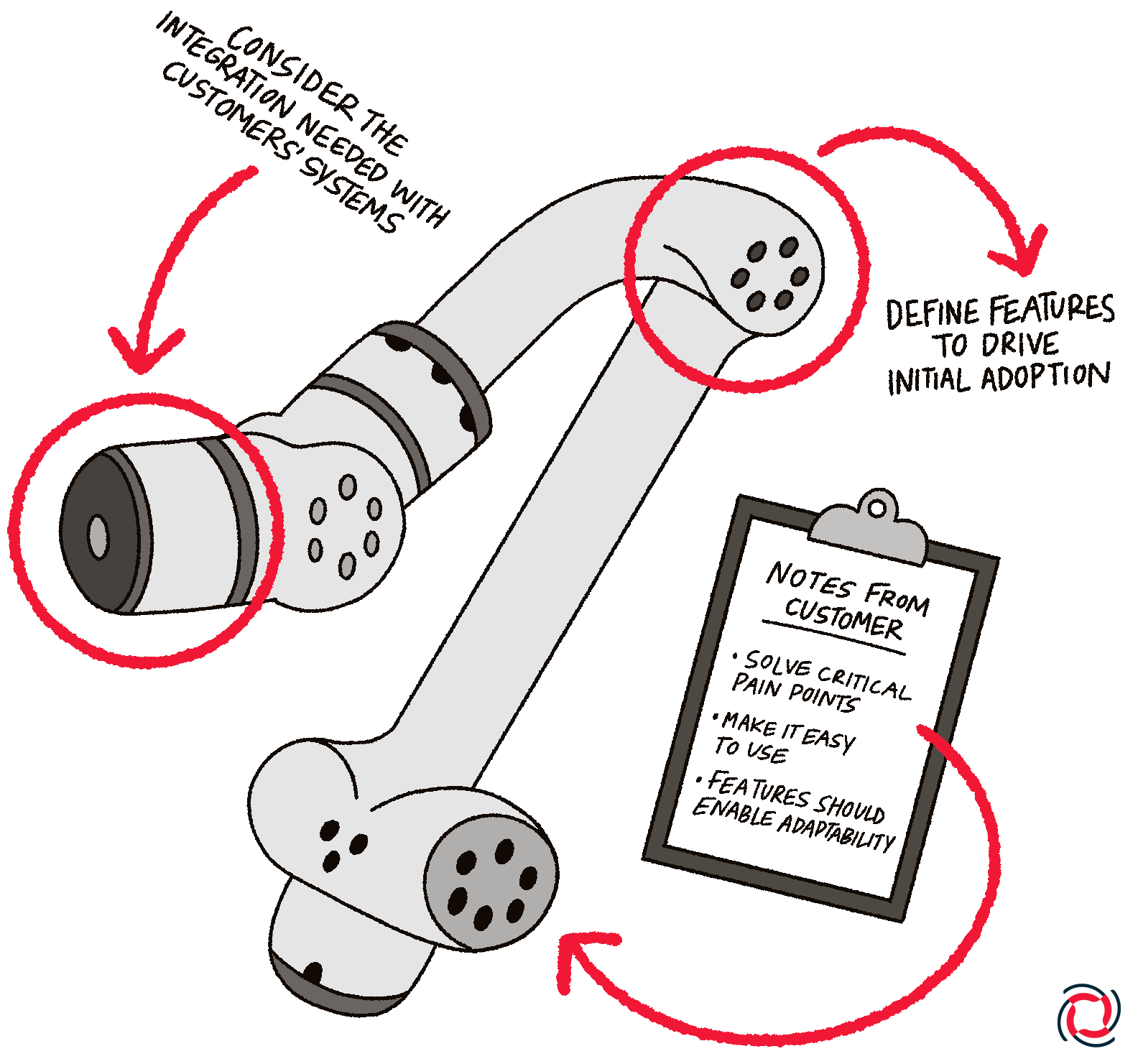

Software startups famously utilize the concept of MVPs – an initial minimum viable product that developers can quickly iterate and continuously improve with the opportunity for fast, incremental advancements in between major software releases. In robotics, the MVP approach can apply to the software, but it is more complex for hardware. Robotics products need to be considered in stages that are defined by the major hardware iterations. A typical progression is: (1) robust prototype, (2) first product for pilots, (3) second product for early production and initial scaling.

This product development journey runs in parallel to identifying your Ideal Customer Profile (ICP) and winning customers. The two activities are heavily intertwined, and the ultimate goal is all about achieving PMF. And you should make some revenue along the way…

Find your first ideal customer profile (ICP)

Finding your first ICP, which can be a single customer or a set of customers, is critical for focusing your product development efforts and go-to-market plans. These are the customers you will take to the pilot testing stage.

Target first customers who are truly early adopters with a willingness to try new solutions. It’s likely that the first deployment of the robot will not be perfect and meet all of your and the customer’s goals, but the right customer will provide high quality feedback and be patient.

| Product-Market Fit Journey to Customer Success | |

|---|---|

| Phase | Key Success Factors |

| Pilot engagement

Goal: Early product-market fit validation |

|

| Early Production

Goal: Lock in customer commitments |

|

For many robotics companies, marketing is a forgotten activity and too often undervalued. Good slide decks and a good website are the basics, but once early customer traction starts, expanded marketing can become a major multiplier for direct sales and customer engagement activities.

Key early stage marketing strategies

Engage customers for marketing impact:

General marketing strategies:

Marketing done well at the early stages should drive inbound interest, complement and feed your sales team, and save on cold calling and hunting for new customer accounts.

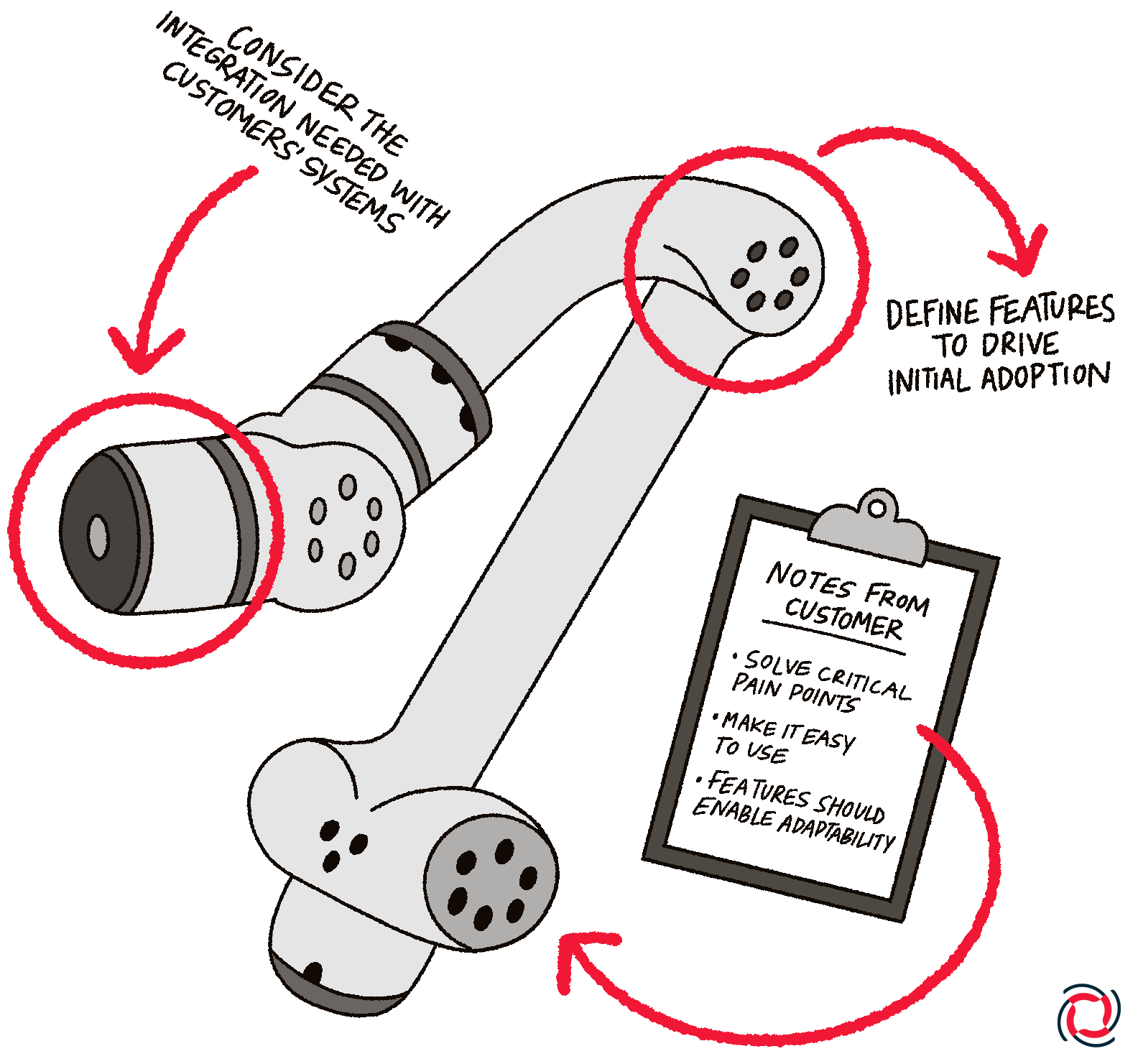

The first 3 to 5 customers often have different attributes than customers 5-10 and customers 10-50. It’s extremely common to learn that you need to add more features and capabilities (hopefully all in software or minor hardware changes) to elevate the value proposition and win over the next wave of new customers.

These insights come from more customer conversations, onsite work with customers in live use of the product and service, and a deeper understanding of customer care-abouts.

| Typical Concepts for Expanding Customer Fit | |

|---|---|

| Impact | Actions |

| Unlock high potential growth |

|

| Maximize value proposition |

|

| Improve Product Effectiveness and Reliability |

|

You have secured your first customer wins, validating your product and reinforcing your confidence in the ICP. With this foundation in place, it is now time to add new customers to your pipeline.

Here’s some of the key next steps:

1 – Refined Customer Segmentation

Using lessons learned from crossing the first chasm, perform a rigorous refresh of your customer segmentation, considering factors such as use case, buying preferences, willingness to take risks, enterprise or SMB, geography, etc.

2 – Expand Customer Outreach

Using your refined and segmented customer targets, drive outreach to new customer targets that fit (or approximately fit) your initial ICP.

3 – Optimize your Sales Process and Customer Engagement

Key aspects include:

A note on the key elements of ROI

An effective way to drive sales within an organization is by clearly demonstrating the return on investment (ROI) of your robotics solution. A comparative chart showcasing how your solution reduces direct costs while simultaneously improving operational efficiency can be a compelling tool for decision-makers.

Additional strategies to showcase ROI include:

4 – Sales Playbook

Start building your Sales Playbook in preparation for adding sales to the team. This will be an evolutionary process but being disciplined about what works (and doesn’t work) and documenting it is a best practice.

5 – Building out the Sales Team

It’s always a good idea to take a direct sales approach in the beginning to maintain control over the customer process, gain insight to the use case, and directly capture invaluable customer feedback and insights. This also gives startups a front row seat from which they can honestly assess the product capability and PMF. It’s common that the startup CEO is the Sales Champion in the early stage of a robotics company. However, as startups prepare to expand beyond first customer success, it’s time to assess your first sales hire to complement the CEO’s activities. The exact timing is very dependent on the needs of the business, the preferences of the CEO, and market dynamics such as sales cycles.

In any scenario, CEOs should be highly discerning when hiring sales candidates who have great industry experience and network, but don’t fit a startup’s culture or have potential for long-term leadership in the company. Mistakes in sales hires is one of the most common team building mistakes a startup CEO will make. The art of scaling your sales team could be an entire Playbook chapter.

6- Expanding Your Channels to Market

Beyond your direct sales activities, the key question is how do you 5-10x your own sales without expanding your team to capitalize on your PMF success and ICP knowledge. There are three typical paths to consider for robotics startups:

With sales partnerships, it’s best to pick an initial partner and test the model to validate a win-win for both parties before scaling it up. Set a realistic time (6 months to 1 year) for these partnerships to gain momentum and be quick to abandon if it’s not working. Finding the right partner(s) can be a great growth accelerator. Engaging the wrong channel partners can be painful causing you to lose time and waste valuable resources on your team to support the failing partner. Pay close attention to distributor agreement terms and make sure your business can afford the gross margin impact.